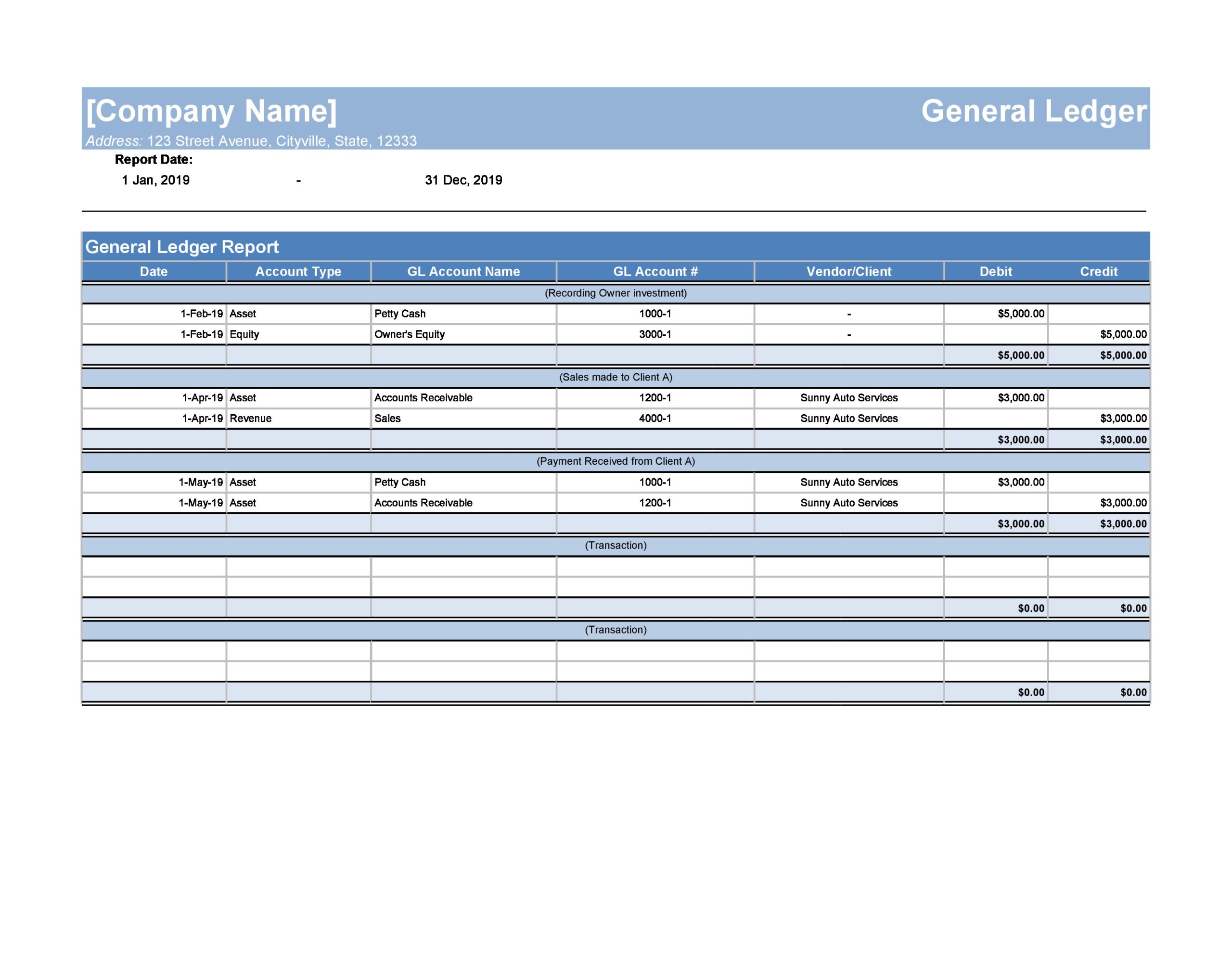

General ledgers provide the date, journal entry, and the entry description, along with the debit or credit amount and the ending balance. Each account lists the journal entries that posted activity to the account during a particular month. General ledgers sort transactions by account. Business owners and accounting professionals use the data in the general ledger to create financial statements.

#HOW TO DO A LEDGER ACCOUNT IN EXCEL HOW TO#

How to use the general ledger to create financial statementsĪ company’s general ledger is a record of every transaction it posts throughout its lifetime, including all journal entries.

#HOW TO DO A LEDGER ACCOUNT IN EXCEL SOFTWARE#

$10,000 assets increase = $10,000 increase liabilities + $0 change equityĪccounting software ensures that each journal entry balances the formula and total debits and credits. On your balance sheet, you’d add the $10,000 increase in liabilities to the $0 change in equity to get a $10,000 assets increase. The company posts a $10,000 debit to cash (an asset account) and a $10,000 credit to bonds payable (a liability account). But assets must stay balanced with liabilities and equity.Īssume, for example, that a business issues a $10,000 bond and receives cash.

You can use the formula to create financial statements. Add liabilities to equity to determine your assets. You can think of equity as the true value of your business.Ī balance sheet formula connects the balance sheet components. Equity is the difference between assets and liabilities.Liabilities include accounts payable and long-term debt. Liabilities are what your business owes to other parties.Assets are the resources you use to produce revenue. Business owners also review income statements and cash flow statements.Ī balance sheet reports your business’s assets, liabilities, and equity as of a specific date. The balance sheet is one of the three basic financial statements that every business owner should analyze to make financial decisions. The balance sheet formula (or accounting equation) determines whether you use a debit or a credit for a particular account.

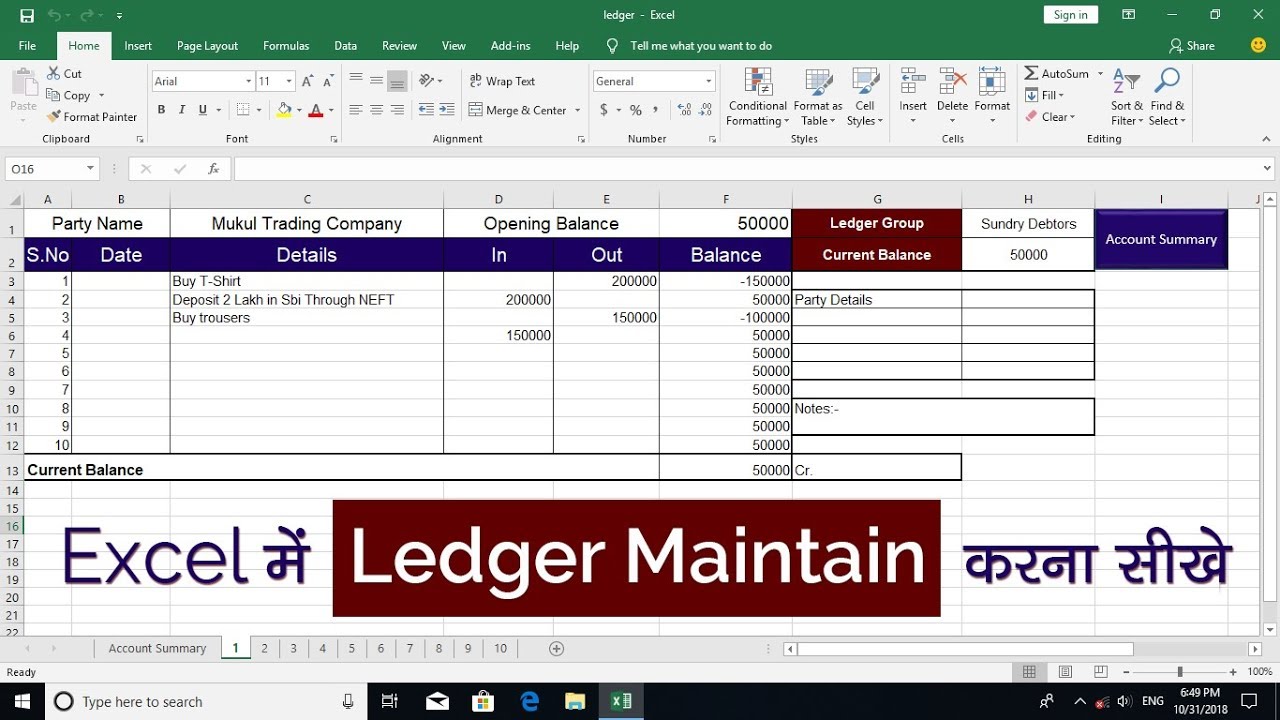

Using the balance sheet formula to post journal entries The first thing they’ll need to do is create a chart of accounts. They’re using an Excel bookkeeping template to manage the business. Let’s look at an example.Ĭenterfield Sporting Goods opened on January 1, 2020. You’ll need to set up accounts, post transactions, and create financial statements using Excel. In the meantime, you’ll still need to understand the accounting process and how you can complete each task using Excel accounting. And bookkeeping in Excel can lead to errors and inefficiency.

As your business grows, you’ll need to post more accounting transactions. But keep in mind that Excel bookkeeping is not a solution for a growing business. Most people are familiar with Excel, and using the application is straightforward. Many small business owners use an Excel accounting template when they start operations. So you may not have automated administrative tasks like bookkeeping and accounting when you open your doors. Your top priorities may be to find customers and deliver a great product or service. When you start your business, time and money may be in short supply.

0 kommentar(er)

0 kommentar(er)